When planning a trip, the allure of adventure often overshadows the dread of what could go wrong. Yet, life, as it often does, throws curveballs. That's when the question of protection, specifically Cost-Benefit Analysis for Flight Insurance, moves from an afterthought to a critical decision. Deciding whether to shell out extra money for a "what if" can feel like a gamble, but a smart traveler knows it's a calculated risk assessment, not a coin toss. It's about weighing the known costs against the potential relief and financial safeguarding.

This guide isn't here to tell you definitively whether to buy flight insurance. Instead, we'll equip you with a robust framework—a personalized cost-benefit analysis—to confidently determine when it's your smart move and when you can safely pass.

At a Glance: Your Flight Insurance Checklist

- What it covers: Primarily flight-related disruptions like cancellations, delays, missed connections, and lost baggage, plus limited emergency medical.

- What it generally doesn't cover: Pre-existing conditions (unless an early purchase), changing your mind, known risks present before buying, extreme sports.

- Typical Cost: 4-10% of your non-refundable trip expenses.

- When to seriously consider it: Expensive, non-refundable international trips; travel during risky seasons; tight schedules; personal health concerns.

- When you likely don't need it: Flexible/refundable tickets; cheap, short domestic flights; strong existing credit card coverage.

- Your Decision Tool: A personalized Cost-Benefit Analysis focusing on your unique trip, financial exposure, and risk tolerance.

Understanding Flight Insurance: Your Basic Safety Net

Think of flight insurance as a focused safety net. Unlike comprehensive travel insurance, which blankets your entire journey from hotels to activities and extensive medical emergencies, flight insurance zeroes in on the most vulnerable part of your travel: the flight itself and its immediate domino effects. It's designed to cushion the blow of unexpected flight-related issues, helping you recover prepaid costs or cover new expenses if your air travel goes awry.

Here's what a typical policy aims to protect:

- Trip Cancellations or Interruptions: If a covered event (like a sudden illness, injury, family death, or job loss) forces you to cancel or cut your trip short, the policy can reimburse prepaid, non-refundable costs for your flights and sometimes other related expenses.

- Flight Delays or Missed Connections: Stuck on the tarmac for hours? Missed your connecting flight because of a previous delay? Flight insurance can help cover unexpected costs like meals, an overnight hotel stay, or even the expense of booking a new flight if your delay extends beyond a certain threshold (often 3-12 hours).

- Lost, Delayed, or Damaged Baggage: When your luggage goes missing or shows up late, policies typically offer funds to purchase essential items until your bags are found, or compensation if they're permanently lost or damaged.

- Emergency Medical Coverage: While limited compared to full travel insurance, flight policies often include a small amount for emergency medical treatment if you fall ill or get injured during your trip.

- Accidental Death or Dismemberment: In the rare and tragic event of a serious accident during your insured travel, this benefit provides a payout.

However, it's just as important to understand its limitations. Flight insurance usually doesn't cover: - Pre-existing medical conditions unless you purchase the policy very soon after booking your trip and meet specific requirements.

- Cancellations simply because you changed your mind or found a cheaper deal.

- Risky activities like extreme sports or travel to destinations with government "do not travel" warnings.

- Minor delays (often under 3-6 hours).

- Known risks that were already apparent before you purchased the policy (e.g., a hurricane already forecasted for your destination).

The cost of this specialized coverage generally ranges from 4-10% of your prepaid trip expenses. This percentage fluctuates based on factors like your age, the length and destination of your trip, and the total amount of coverage you're seeking. For major issues, policies typically reimburse between $1,000 and $100,000 per person.

Why a Cost-Benefit Analysis is Your Best Travel Companion

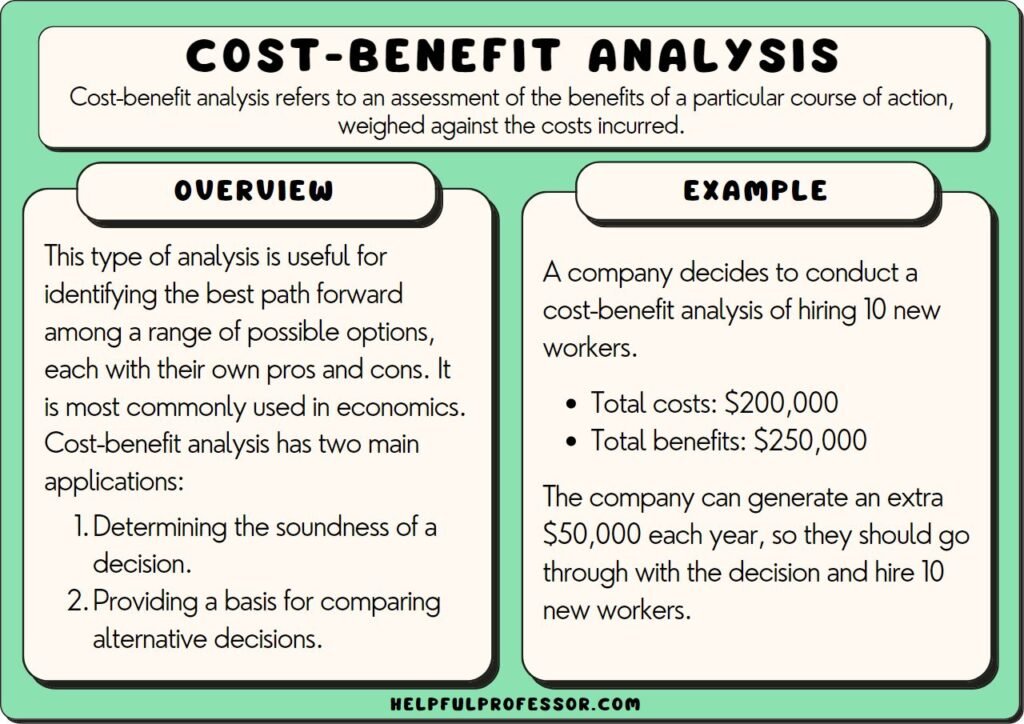

Deciding on flight insurance isn't just about reading the fine print; it's about making a smart financial decision tailored to your specific situation. That's where a Cost-Benefit Analysis (CBA) comes into play. A CBA isn't just for big corporations; it's a powerful, structured approach to evaluating decisions by methodically comparing all associated costs and benefits.

For your travel plans, a CBA moves you beyond a gut feeling or anecdotal stories. It forces you to quantify the financial implications of both buying and not buying flight insurance, alongside considering less tangible factors like peace of mind. This structured evaluation helps you make data-driven decisions, transforming potential regret into informed confidence. It's about seeing the full picture of financial risk and reward before you commit.

Step-by-Step: Conducting Your Flight Insurance CBA

Let's break down how to apply a practical Cost-Benefit Analysis specifically for your flight insurance decision.

1. Frame Your Decision: Insure or Not Insure?

Before you can weigh options, you need to clearly define the alternatives. For flight insurance, this is straightforward:

- Alternative 1: The "Status Quo" (No Insurance). What are the potential costs and non-financial consequences if something goes wrong and you don't have insurance? This becomes your baseline.

- Alternative 2: Purchasing Flight Insurance. What are the direct costs (the premium) and the potential financial and non-financial benefits (reimbursements, peace of mind)?

Your goal here is to analyze your current travel environment: the specifics of your flight, your financial exposure, and any personal vulnerabilities. What are you primarily trying to protect? Is it a non-refundable, multi-thousand-dollar international flight, or a $200 domestic hop that you could easily rebook?

2. Identify and Quantify the Costs

This step is about putting a dollar figure on everything you'd spend if you opt for the insurance.

- Direct Cost: The Premium. This is the most obvious cost. Get a quote for a policy that meets your needs. If your flight is $1,500 and the insurance is 7% of that, your direct cost is $105.

- Example: For a $1,200 non-refundable international flight, a 6% flight insurance premium would be $72.

- Indirect Costs: Consider the time you spend researching and purchasing policies. While not always easily monetized for a single decision, it's a factor if you value your time highly. For most individual travelers, this is negligible but worth a passing thought.

3. Identify and Quantify the Potential Benefits (and Avoided Costs)

This is where you look at what you gain by having insurance, which often translates to financial losses you avoid.

- Financial Benefits (Avoided Losses): These are the amounts you could be reimbursed for.

- Trip Cancellation/Interruption: What is the total non-refundable cost of your flight(s)? This is your maximum potential loss. Example: Your $1,200 international flight is non-refundable. This is the primary financial benefit you're protecting.

- Flight Delays/Missed Connections: Estimate potential costs if you're stranded. A hotel room, meals, and possibly a new flight could easily add up. Example: An unexpected overnight stay could cost $150 for a hotel and $50 for meals.

- Lost, Delayed, or Damaged Baggage: What would it cost to replace essential items if your luggage is delayed for a few days or permanently lost? Example: $200-$300 for immediate necessities like clothing and toiletries.

- Emergency Medical (Limited): While typically small, even a basic doctor's visit or prescription abroad can incur unexpected costs. Example: A minor clinic visit for an ear infection might be $100-$150 out-of-pocket without coverage.

- Non-Financial Benefits: These are crucial but harder to quantify in dollars.

- Peace of Mind: Knowing you're covered if things go wrong significantly reduces stress and anxiety, allowing you to enjoy your trip more fully. How much is that worth to you?

- Reduced Decision Fatigue: In a crisis, having a clear path (contacting your insurer) can be invaluable.

Flight Insurance vs. Travel Insurance: A Quick Comparison

As you consider benefits, it's vital to distinguish between flight insurance and comprehensive travel insurance. - Flight Insurance: Cheaper (typically $30-$100 for a single flight), highly focused on flight disruptions and related immediate costs, with minimal medical aid. Ideal for protecting a high-value flight segment of a trip.

- Travel Insurance: More expensive ($100-$500+ for an entire trip), covers the whole journey (flights, hotels, activities), and offers extensive emergency medical and evacuation support. Best for complex, multi-component trips with significant overall investment.

The choice depends entirely on your total trip investment and complexity. If your flight is the main financial risk, flight insurance might suffice. If you have expensive non-refundable hotels, tours, or significant medical concerns, broader travel insurance is usually the wiser choice.

4. Assess Your Risks & Personal Comfort

Now, layer in the specific risks of your trip and your personal tolerance for those risks.

- Trip-Specific Risks:

- Cost and Non-Refundability: Is your flight ticket truly non-refundable? Is it expensive (generally over $1,000 per person)? The higher these figures, the greater your financial exposure and the stronger the case for insurance.

- Destination Factors: Are you traveling during a known risky season (e.g., winter storms in the Northeast, hurricane season in the Caribbean, monsoon season in Southeast Asia)? Is your destination prone to political instability, or does it have an unreliable infrastructure or healthcare system?

- International Travel with Connections: Multi-leg international journeys inherently carry higher risks of delays and missed connections, especially if tight transfer times are involved.

- Time-Sensitive Travel: Are you flying for a wedding, a critical business meeting, or an event with strict deadlines? The cost of missing it goes beyond money.

- Traveler-Specific Risks:

- Health Concerns: Do you or a traveling companion have pre-existing health issues that could flare up? (Remember the limitations regarding pre-existing conditions).

- Existing Coverage: Crucially, review your existing credit card benefits (if you booked with one), work benefits, or personal health insurance. Many premium credit cards offer surprisingly robust travel protections. Are these sufficient for your trip?

- Personal Comfort with Financial Risk: How would a sudden, unexpected $1,500 loss impact your personal finances? Could you absorb it without significant hardship, or would it be a major blow? Your individual financial resilience plays a huge role.

Systematically evaluating these financial, technical (e.g., airline reliability), and schedule risks helps you understand the probability and consequence of something going wrong.

5. Weighing Your Options: When to Lean In (and When to Pass)

With all the costs, benefits, and risks laid out, it's time to compare your alternatives and make a recommendation.

When Flight Insurance Shines (The "Yes" Scenarios):

- Expensive, Non-Refundable Trips: If your flight alone (or combined with immediate related costs) is over $1,000 per person and non-refundable, the premium becomes a small price to pay for substantial protection.

- International Travel with Multiple Parts: More complex itineraries mean more opportunities for something to go wrong.

- Travel During Risky Seasons: Think winter storms causing cancellations, hurricane season threatening coastal destinations, or periods of widespread illness.

- Travelers with Health Concerns or Tight Schedules: If a personal health issue could realistically derail your trip, or if missing an event isn't an option, insurance provides a critical safety net.

- Lack of Adequate Existing Coverage: If your credit card or other personal policies don't offer sufficient protection for your specific trip's value and risks.

When You Can Likely Skip It (The "No" Scenarios): - Refundable/Flexible Tickets: If you can change or cancel your flight without a significant penalty, the core benefit of insurance is diminished.

- Short, Cheap Domestic Flights (Under $300): The potential loss is often small enough that the premium feels disproportionate. You might be able to absorb the loss or rebook cheaply.

- Sufficient Existing Credit Card Coverage: Many premium travel cards offer excellent trip cancellation, delay, and baggage insurance. Always check your card's benefits guide.

- Low Financial Risk: If you can easily absorb the full cost of your non-refundable flight without financial stress, and you're comfortable with the risks, then the "cost" of the premium might outweigh the "benefit."

The goal is to present an investment recommendation backed by this comprehensive analysis. Make all financial, non-financial, and risk consequences visible. If the potential avoided losses (benefits) significantly outweigh the premium (cost), and the risks are notable, then insurance is a prudent choice. If the costs are high, the benefits minimal, or your existing coverage is strong, passing on the insurance might be the smarter play.

FAQs: Quick Answers to Your Burning Questions

Travel insurance can be confusing. Here are some common questions travelers ask:

Q: When is the best time to purchase flight insurance?

A: Generally, you can buy flight insurance anytime between booking your trip and a day or two before departure. However, for certain benefits, like coverage for pre-existing medical conditions or "cancel for any reason" upgrades (if available), you often need to purchase within a specific window, usually 10-20 days of your initial trip booking. It’s always best to buy it sooner rather than later to ensure maximum coverage.

Q: Does flight insurance cover pre-existing medical conditions?

A: Typically, standard flight insurance policies exclude pre-existing medical conditions. To get coverage for them, you usually need to purchase your policy very early (often within 10-21 days of your initial trip deposit) and meet specific criteria, like being medically able to travel when you purchase.

Q: Can I get a refund if I cancel my flight insurance policy?

A: Most flight insurance policies are non-refundable after purchase. However, some companies offer a "free look" period, typically 10-15 days, during which you can review the policy and cancel for a full refund if you change your mind, provided you haven't filed a claim or departed on your trip. Always check the policy details for this specific clause.

Q: Is pregnancy covered by flight insurance?

A: Pregnancy complications that arise after you've purchased the policy may be covered, similar to any other unexpected illness. However, routine pregnancy care, elective abortions, or travel restrictions due to a normal, uncomplicated pregnancy are typically not covered. If you're pregnant, it's crucial to read the policy's medical coverage section carefully and potentially discuss it with the insurer.

Your Next Step: Make an Informed Decision

Ultimately, the decision to purchase flight insurance is deeply personal, rooted in your specific travel plans, financial situation, and comfort with risk. By conducting a personalized Cost-Benefit Analysis, you're not just guessing; you're making an informed choice.

Review your trip's cost and non-refundable expenses, scrutinize your existing coverage from credit cards or other sources, assess the risks associated with your destination and timing, and honestly evaluate your personal ability to absorb unexpected financial setbacks. This structured thinking empowers you to move forward with confidence, knowing you've made the smartest decision for your journey. Safe travels!